Endowment funds represent permanent financial foundations supporting educational missions across generations. Unlike annual fundraising that covers immediate operational needs, endowments provide perpetual income streams through investment returns—funding scholarships, faculty positions, programs, and institutional priorities long after original donors pass. Schools with substantial endowments weather economic downturns more effectively, attract exceptional faculty through endowed positions, provide financial aid expanding access, and maintain program quality regardless of enrollment fluctuations.

Yet many development officers face uncertainty about endowment establishment mechanics—legal structures required, minimum fund sizes appropriate, board governance systems necessary, investment strategies suitable, gift acceptance policies essential, and donor recognition approaches that inspire endowment commitments while honoring generosity appropriately across decades.

Building Endowment Funds Through Strategic Recognition

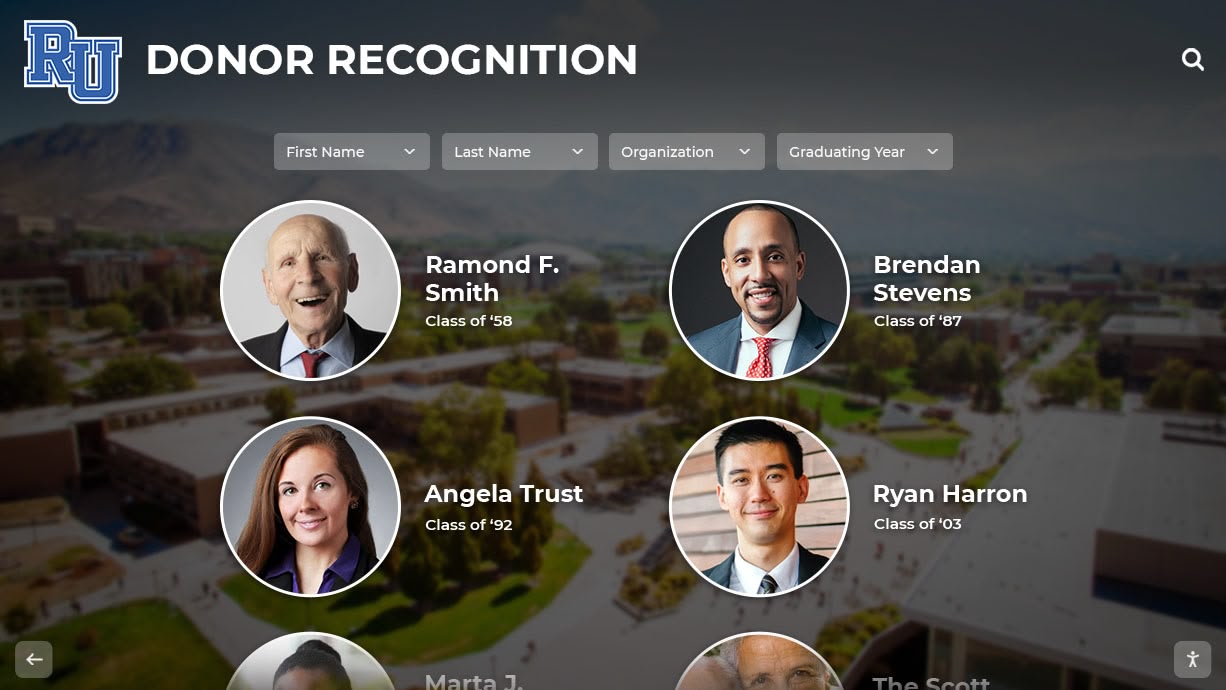

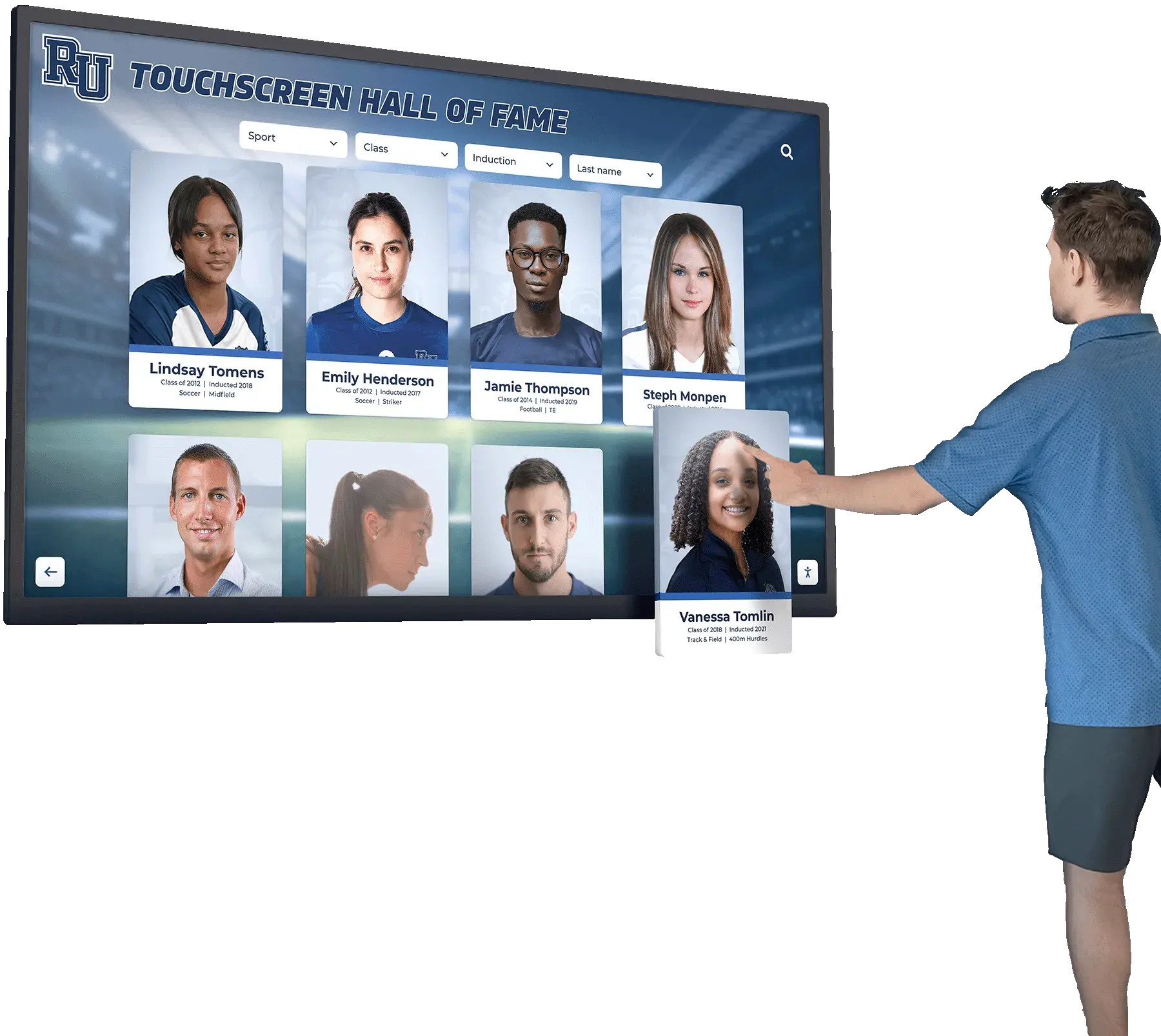

Establishing a successful endowment fund for your nonprofit school demands systematic planning addressing legal structure, governance framework, investment policy, gift acceptance procedures, and donor recognition infrastructure. Schools achieving endowment growth share common characteristics including clear fund purposes aligned with institutional mission, professional investment management balancing growth with preservation, comprehensive gift acceptance policies guiding complex contributions, transparent governance maintaining donor confidence, and strategic recognition systems honoring endowment contributors appropriately. Modern digital recognition solutions like Rocket Alumni Solutions provide purpose-built platforms specifically designed for endowment donor recognition, offering unlimited capacity for contributors across generations, immediate content updates celebrating new endowment gifts, rich multimedia storytelling demonstrating endowment impact, and engagement analytics revealing recognition effectiveness—all essential infrastructure for programs requiring sustained donor cultivation across multi-decade timelines.

Understanding Endowment Funds: Definition and Strategic Purpose

Endowment funds function as permanent investment pools where organizations preserve principal while using income generated through investment returns to support ongoing operations, programs, or specific designated purposes. This financial structure creates sustainable revenue streams independent of tuition, enrollment, or annual fundraising volatility.

What Makes Endowment Funds Different from Other Assets

Endowment funds differ fundamentally from regular operating accounts and reserve funds across several critical dimensions:

Permanence and Restricted Use

True endowments maintain principal in perpetuity—organizations never spend down the original contributed amounts. Donors establish endowments specifically because they want their gifts supporting institutional missions forever, not just addressing immediate needs. This perpetual nature means a $100,000 scholarship endowment continues funding students decades or centuries after establishment, while equivalent annual fund gifts support just single-year operations.

Board-approved spending policies typically permit organizations to distribute 4-5% of endowment value annually—calculated through rolling multi-year averages smoothing market volatility. This means a $1 million endowment generates approximately $40,000-$50,000 annually for designated purposes while preserving principal and allowing growth through reinvested returns exceeding distributions.

Investment Approach and Timeline

Endowment investment strategies emphasize long-term growth balanced with principal preservation. Unlike operating accounts requiring liquidity and capital protection, endowments tolerate measured risk pursuing higher returns across multi-decade timeframes. Professional investment managers construct diversified portfolios including equities, fixed income, real estate, private equity, and alternative investments—allocations inappropriate for short-term operating funds but essential for endowment growth.

Restricted Purpose and Donor Intent

Many endowment gifts include specific donor restrictions designating exactly how investment income may be used—scholarship support for students meeting particular criteria, faculty salary supplements for specific departments, program funding for designated activities, or facility maintenance for particular buildings. Organizations must honor these restrictions perpetually, requiring careful fund accounting tracking multiple endowment purposes simultaneously.

Unrestricted endowments without specific donor designations provide maximum institutional flexibility—boards determine annually how to allocate investment income across priorities. However, many donors prefer restricted endowments ensuring their philanthropic intent receives permanent focus regardless of future leadership or institutional direction changes.

Common Endowment Types for Educational Institutions

Schools establish endowment funds supporting diverse institutional priorities:

Scholarship Endowments

Student financial aid represents the most common endowment purpose:

- Named Scholarships: Honoring donors, family members, or distinguished alumni while providing ongoing student support

- Merit-Based Awards: Funding academic achievement recognition rewarding exceptional students

- Need-Based Aid: Expanding access for talented students facing financial barriers

- Program-Specific Support: Scholarships targeting students in particular academic programs, athletic teams, or artistic disciplines

- Diversity Initiatives: Supporting underrepresented student populations advancing institutional inclusion goals

Scholarship endowments prove especially appealing to donors because they create tangible human impact—real students receiving education they couldn’t otherwise afford. Schools implementing strategic donor recognition systems often feature scholarship recipient profiles alongside endowment donor recognition, demonstrating direct philanthropic impact inspiring additional commitments.

Faculty Position Endowments

Endowed positions attract and retain exceptional educators:

- Endowed Chairs: Senior faculty positions with substantial salary supplements and research support

- Professorships: Mid-level positions providing competitive compensation enhancements

- Teaching Fellowships: Supporting early-career faculty or graduate student instructors

- Visiting Positions: Funding distinguished visitors bringing fresh perspectives

- Professional Development: Supporting faculty research, conference attendance, or advanced study

Faculty endowments typically require substantial principal—$1-2 million minimum for named chairs, $500,000-$1 million for professorships—because investment income must provide meaningful compensation supplements attracting quality candidates.

Program Support Endowments

Permanent funding ensures program sustainability:

- Academic Department Operations: Funding special equipment, guest speakers, field experiences, or enhanced programming

- Athletic Program Support: Covering equipment, travel, facility maintenance, or coaching supplements

- Arts Programming: Supporting theater productions, musical performances, gallery exhibitions, or artist residencies

- Library Resources: Funding collection development, technology systems, or specialized resources

- Technology Infrastructure: Supporting ongoing system upgrades, equipment replacement, or innovation initiatives

General Operating Endowments

Unrestricted endowments provide maximum institutional flexibility—supporting highest-priority needs as determined by current leadership. While less appealing to many donors than restricted funds with specific tangible purposes, general operating endowments prove most valuable to institutions requiring adaptability across changing circumstances.

Phase 1: Legal Structure and Governance Framework

Proper endowment establishment requires careful attention to legal requirements, governance structures, and policy frameworks ensuring compliant effective management.

Establishing Legal Structure and Nonprofit Compliance

Endowment funds must conform to nonprofit regulations and fiduciary standards:

501(c)(3) Status Requirements

Educational institutions operating under IRS 501(c)(3) designation must ensure endowment establishment and management comply with tax-exempt organization requirements:

- Charitable Purpose Alignment: Endowment purposes must advance exempt educational missions

- Private Benefit Prohibitions: Investment income cannot provide improper benefits to insiders or private individuals

- Excess Benefit Transaction Rules: Compensation or contracts with board members require careful structuring avoiding prohibited transactions

- Unrelated Business Income: Investment activities generating business income unrelated to educational purposes may trigger taxation

- Form 990 Reporting: Annual information returns must disclose endowment holdings, investment policies, and distributions

Organizations establishing first endowments should consult nonprofit legal counsel ensuring compliance with applicable federal and state regulations. States often impose additional requirements through charitable solicitation laws, uniform management of institutional funds acts, or specific endowment reporting mandates.

UPMIFA Compliance

The Uniform Prudent Management of Institutional Funds Act—adopted in most states—establishes fiduciary standards for endowment management:

- Prudent Investment Standards: Requiring diversification, risk-appropriate strategies, and regular monitoring

- Spending Policy Requirements: Limiting distributions to amounts preserving long-term endowment value

- Donor Intent Preservation: Mandating organizations honor gift restrictions perpetually

- Delegation Authority: Permitting appropriate delegation to investment professionals while maintaining board oversight

- Modification Procedures: Establishing processes for adjusting outdated restrictions when donor intent becomes impossible or wasteful

Understanding UPMIFA requirements protects organizations from liability while ensuring sound endowment stewardship maintaining donor confidence and public trust.

Creating Board Governance and Investment Committees

Strong governance structures ensure effective endowment oversight:

Board Responsibilities and Fiduciary Duties

School boards or trustees bear ultimate legal responsibility for endowment stewardship:

Fiduciary Duty of Care: Requiring informed decision-making based on thorough analysis and professional advice. Boards must understand investment strategies, monitor performance regularly, and ensure policies align with institutional circumstances and endowment purposes.

Fiduciary Duty of Loyalty: Demanding decisions prioritizing institutional interests over personal benefit. Board members cannot use positions for private advantage or allow conflicts of interest to compromise judgment.

Fiduciary Duty of Obedience: Requiring faithful adherence to donor restrictions and institutional mission. Boards must ensure endowment income supports designated purposes exactly as donors intended.

These duties apply collectively—boards cannot simply delegate endowment oversight to staff or external managers without maintaining informed engaged supervision demonstrating proper fiduciary care.

Investment Committee Structure

Most institutions establish specialized investment committees providing focused endowment oversight:

Committee Composition: Typically including 5-9 members combining board trustees, external financial experts, and occasionally senior administrators. Effective committees balance institutional knowledge with investment expertise—recruiting members with professional background in asset management, institutional investing, financial planning, or related fields.

Committee Responsibilities: Investment committees typically manage policy development, investment manager selection and monitoring, performance review and reporting, spending policy recommendations, and risk management oversight. Clear committee charters document specific authorities, meeting frequencies, reporting requirements, and decision-making processes.

Term Limits and Rotation: Staggered terms ensure continuity while bringing fresh perspectives. Three-year terms with annual rotation of one-third of members balance institutional memory against potential staleness from unchanging membership.

Resources on institutional governance best practices demonstrate how transparent oversight structures build donor confidence essential for endowment growth.

Developing Investment Policy Statements

Written investment policies provide essential frameworks guiding endowment management:

Core Policy Components

Comprehensive investment policy statements address multiple critical elements:

Investment Objectives: Articulating specific goals such as “generate average annual returns of 7% over rolling ten-year periods while preserving inflation-adjusted principal value.” Clear objectives enable performance evaluation and guide strategy selection.

Risk Tolerance: Defining acceptable volatility levels and maximum loss thresholds reflecting institutional circumstances. Schools with small endowments relative to operating budgets may require conservative approaches, while institutions with substantial endowments supporting modest percentages of budgets tolerate greater short-term volatility pursuing higher long-term returns.

Asset Allocation: Establishing target percentages for major asset classes—domestic equities, international stocks, fixed income, real estate, private equity, alternative investments, and cash equivalents. Typical endowment allocations might target 40-50% equities, 20-30% fixed income, 10-20% alternatives, and 5-10% cash depending on risk tolerance and timeline.

Rebalancing Procedures: Specifying when and how portfolios return to target allocations after market movements create drift. Common approaches include calendar-based rebalancing quarterly or annually, threshold-based rebalancing when allocations exceed targets by predetermined percentages, or hybrid approaches combining both methods.

Spending Policy: Defining annual distribution calculations—typically 4-5% of trailing three-year average endowment market value. This smoothing mechanism prevents dramatic spending swings from short-term market volatility while maintaining distributions roughly consistent with long-term sustainable rates.

Performance Benchmarks: Establishing comparison standards evaluating investment results. Appropriate benchmarks might include blended market indices matching asset allocation targets, peer institution endowment returns, or inflation-plus targets ensuring real value preservation.

Delegation and Authority: Clarifying board, committee, staff, and external manager responsibilities. Policies should specify who selects investment managers, which decisions require committee or board approval, what reporting frequencies apply, and how performance reviews occur.

Phase 2: Investment Strategy and Fund Management

Effective investment management balances growth objectives against principal preservation requirements while maintaining appropriate risk levels.

Selecting Investment Approaches and Managers

Institutional endowments require professional investment management:

Internal vs. External Management

Organizations face fundamental decisions about investment oversight models:

Internal Management: Larger institutions sometimes employ dedicated investment staff managing endowments directly. This approach provides maximum control and potentially reduces fees but requires substantial resources supporting professional personnel, research systems, trading infrastructure, and compliance oversight. Internal management typically becomes viable only for endowments exceeding $50-100 million where cost efficiencies justify infrastructure investment.

External Management: Most schools contract with external investment advisors or asset managers providing professional oversight. Options include:

- Balanced Fund Managers: Single firms managing complete portfolios across all asset classes

- Multi-Manager Approaches: Specialized managers handling different portfolio segments coordinated through consultant oversight

- Outsourced CIO Services: Comprehensive solutions providing investment management, reporting, and administration for fixed fees

- Investment Consultants: Advisors helping select and monitor multiple underlying managers without direct management authority

Manager Selection Criteria

Evaluating investment managers requires thorough due diligence:

Investment Philosophy and Process: Understanding how managers make decisions, construct portfolios, manage risk, and adapt strategies. Effective processes demonstrate consistency, discipline, and alignment with endowment objectives rather than trendy approaches or performance chasing.

Track Record and Performance: Reviewing historical returns across complete market cycles including downturns revealing risk management effectiveness. Five-to-ten-year performance records provide more meaningful insight than short-term results potentially reflecting market luck rather than skill.

Fees and Cost Structure: Comparing management fees, transaction costs, and total expense ratios. While lowest-cost options don’t always prove best, fees significantly impact long-term returns—1% annual fee differences compound to substantial wealth transfer over decades.

Organizational Stability: Assessing firm longevity, key person risk, assets under management, client retention, and operational infrastructure. Manager changes or firm instability create continuity risks potentially disrupting investment strategies.

Reporting and Communication: Evaluating transparency, communication frequency, performance attribution methodology, and committee interaction approach. Strong managers provide clear accessible reporting helping non-expert committee members understand strategies and results.

Implementing Asset Allocation Strategies

Diversified portfolios balance competing objectives:

Traditional Asset Classes

Core endowment holdings include fundamental investment categories:

Domestic Equities (25-40% typical allocation): U.S. stocks providing growth potential and inflation protection. Endowments typically hold diversified portfolios across large-cap, mid-cap, and small-cap companies spanning multiple economic sectors. While volatile short-term, equities historically deliver strongest long-term returns essential for endowment growth exceeding inflation and distributions.

International Equities (15-25% typical allocation): Non-U.S. stocks providing geographic diversification and exposure to global economic growth. International holdings reduce portfolio correlation to domestic markets while capturing opportunities in faster-growing emerging economies.

Fixed Income (20-35% typical allocation): Bonds and other debt securities providing income and volatility dampening. Fixed income allocations typically include government bonds, investment-grade corporate debt, and potentially high-yield securities depending on risk tolerance. Bonds generally move differently than stocks—providing portfolio stabilization during equity market declines.

Cash Equivalents (3-8% typical allocation): Money market funds and short-term securities providing liquidity for distributions and tactical opportunities. While generating modest returns, cash reserves enable distributions without forced selling during market downturns and provide flexibility capturing attractive investment opportunities when they arise.

Alternative Investments

Sophisticated endowments often include non-traditional assets:

Real Estate (5-15% typical allocation): Direct property ownership or real estate investment trusts providing inflation protection, income generation, and equity market diversification. Real estate historically demonstrates low correlation with stock and bond markets while delivering returns between those asset classes.

Private Equity (5-15% typical allocation): Investments in non-publicly-traded companies through venture capital, buyout funds, or direct ownership. Private equity potentially offers enhanced returns exceeding public markets but requires long investment horizons, tolerating illiquidity, and accepting limited transparency during holding periods.

Hedge Funds and Absolute Return Strategies (5-15% typical allocation): Alternative investment approaches pursuing returns independent of traditional market direction. Strategies might include long-short equity, global macro, event-driven, or market-neutral approaches. Alternative investments aim to reduce overall portfolio volatility while providing diversification beyond traditional stock and bond holdings.

Natural Resources and Commodities (3-8% typical allocation): Direct or indirect exposure to timber, farmland, energy, precious metals, or commodity futures. These investments provide inflation protection and further diversification, though typically with higher volatility and specialized expertise requirements.

Smaller endowments—particularly those under $5 million—often lack scale justifying alternative investment complexity. These institutions typically emphasize traditional diversified portfolios through mutual funds or pooled investment vehicles providing professional management at accessible minimums.

Establishing Spending Policies and Distribution Rules

Disciplined spending policies balance current needs against long-term sustainability:

Common Spending Policy Approaches

Several methodologies guide annual distribution calculations:

Percentage of Market Value: Distributing fixed percentage of current endowment value—typically 4-5%. Simple and transparent, this approach directly ties spending to assets but creates volatility as distributions swing with market fluctuations. A $1 million endowment distributing 5% provides $50,000 annually when fully valued but only $40,000 following 20% market decline.

Rolling Average Methods: Calculating distributions based on trailing multi-year average endowment values—commonly three or five years. This smoothing mechanism moderates spending volatility while maintaining reasonable correlation to endowment size. Many institutions favor this approach balancing predictability against responsiveness.

Inflation-Adjusted Approaches: Increasing prior year spending by inflation rate regardless of market performance. This method provides maximum budget predictability but disconnects distributions from endowment value—potentially distributing excessively during market declines or inadequately during growth periods.

Hybrid Models: Combining elements from multiple approaches—perhaps weighted averages of market value and prior spending adjusted for inflation. Sophisticated policies balance competing priorities accepting complexity for improved outcomes.

Resources on comprehensive fundraising program development demonstrate how endowment income integrates with broader institutional advancement strategies.

Balancing Current Needs and Long-Term Preservation

Spending policies navigate fundamental tensions between present and future:

Intergenerational Equity: Fair endowment stewardship serves current and future beneficiaries equally. Excessive current spending depletes resources for future generations while overly conservative policies sacrifice present opportunities unnecessarily. Sustainable spending maintains inflation-adjusted purchasing power perpetually—neither growing nor shrinking real endowment value over time.

Budget Stability Requirements: Institutions build operating budgets around expected endowment distributions—requiring reasonable spending predictability enabling effective planning. Extreme distribution volatility creates budget management challenges potentially forcing program cuts during market downturns or leaving opportunities unfunded during growth periods.

Market Cycle Management: Spending policies must function across complete economic cycles including sustained market declines. Policies permitting unsustainably high distributions during bull markets create budget crises when downturns arrive and depleted endowments generate insufficient income supporting established spending levels.

Most investment experts recommend total endowment spending—including distributions plus investment management fees—remain below 5% long-term. Higher spending risks gradually depleting principal while lower rates create permanent wealth accumulation potentially inappropriate for organizations established to serve current missions rather than building empires.

Phase 3: Gift Acceptance Policies and Donor Relations

Clear gift acceptance frameworks and strategic donor cultivation build endowment funds effectively:

Developing Comprehensive Gift Acceptance Policies

Written policies guide staff and donors regarding acceptable gift types and restrictions:

Acceptable Gift Types and Structures

Endowment contributions take diverse forms requiring different handling:

Cash Gifts: The simplest endowment contributions—checks, wire transfers, or electronic payments immediately available for investment. Cash gifts require minimal processing beyond deposit, acknowledgment, and fund accounting.

Appreciated Securities: Stocks, bonds, or mutual fund shares transferred directly to institutions. Securities gifts provide tax advantages for donors—avoiding capital gains taxes while claiming charitable deductions for full fair market value. Organizations must establish brokerage accounts receiving security transfers and policies addressing holding versus liquidation decisions.

Real Estate: Property contributions requiring professional appraisals, environmental assessments, title reviews, and liquidity planning. Real estate gifts demand careful evaluation—accepting property encumbered with liens, environmental contamination, or uncertain marketability creates liabilities exceeding potential benefits. Policies should require board approval for property gifts and specify evaluation criteria protecting institutional interests.

Planned Gifts and Bequests: Commitments providing future endowment funding through estate plans, charitable remainder trusts, charitable gift annuities, or other deferred giving vehicles. Planned gifts create recognition opportunities before institutions receive actual funds but require careful documentation and stewardship ensuring donors fulfill intentions.

Life Insurance Policies: Paid-up policies with cash value or new policies where donors pay premiums naming institutions as beneficiaries. Insurance gifts require evaluation of policy value, premium obligations, and potential liquidity timing before acceptance.

Tangible Personal Property: Art, collections, equipment, or other physical assets potentially sold funding endowments. Like real estate, tangible property requires appraisal, marketability assessment, and storage consideration before acceptance.

Minimum Gift Thresholds

Policies typically establish minimum amounts for named endowments:

Named Endowed Scholarships: Commonly requiring $25,000-$100,000 minimum depending on institutional size and distribution policies. At 4% spending, a $50,000 endowment generates $2,000 annually—meaningful student support justifying permanent recognition. Smaller schools sometimes accept $25,000 minimums while larger institutions require $50,000-$100,000 ensuring distributions provide substantial impact.

Endowed Faculty Positions: Requiring substantially larger commitments—$500,000-$1,000,000 for professorships, $1,000,000-$2,000,000 for endowed chairs. Investment income must provide significant salary supplements attracting exceptional talent, necessitating substantial principal supporting meaningful distributions.

Program Endowments: Varying based on program scope and support requirements. Department endowments might require $100,000-$250,000 minimums while comprehensive program support may demand $250,000-$500,000 depending on intended use.

Pooled Endowments: Smaller contributions that don’t meet naming thresholds sometimes combine into pooled endowments supporting general institutional priorities. This approach enables modest gifts supporting endowment growth while reserving individual naming opportunities for substantial commitments.

Establishing realistic minimums requires careful analysis of spending policies, program costs, and recognition significance. Excessively low thresholds create administrative burden managing numerous small endowments generating insufficient income supporting stated purposes. Conversely, unrealistic high minimums discourage potential donors lacking capacity for largest gifts.

Cultivating Endowment Donors and Managing Complex Gifts

Successful endowment building requires patient donor cultivation and expert gift facilitation:

Identifying Endowment Prospects

Certain donor characteristics suggest endowment gift potential:

Planned Giving Indicators: Donors expressing interest in legacy creation, estate planning discussions, or multi-generational impact demonstrate endowment prospect qualities. Age also correlates with endowment interest—donors over 60 increasingly consider estate plans and legacy commitments beyond immediate annual giving.

Prior Major Gifts: Donors making substantial current gifts often consider endowment commitments ensuring perpetual support for valued programs. Demonstrating stewardship excellence with current gifts builds confidence encouraging endowment consideration.

Program Passion: Deep commitment to specific programs, departments, or student populations often translates to endowment interest ensuring permanent support. Donors closely connected to particular areas prove more likely to fund restricted endowments than general operating support.

Professional Background: Financial professionals, business executives, and high-net-worth individuals often appreciate endowment concepts more readily than general donor populations. Their professional experience with investment management, compound growth, and strategic planning accelerates endowment cultivation conversations.

Estate Capacity: Donors with substantial estates relative to annual giving levels represent prime planned gift prospects. Individuals contributing modest annual amounts but possessing significant assets often make transformational endowment commitments through estate plans exceeding lifetime giving by factors of ten or more.

Cultivation Strategies for Endowment Commitments

Endowment fundraising requires different approaches than annual giving:

Education and Concept Introduction: Many donors lack familiarity with endowment mechanics—requiring patient education about perpetual principal, spending rates, investment management, and long-term impact. Effective cultivation includes clear accessible explanations helping donors understand how endowment gifts create lasting legacies different from immediate-use contributions.

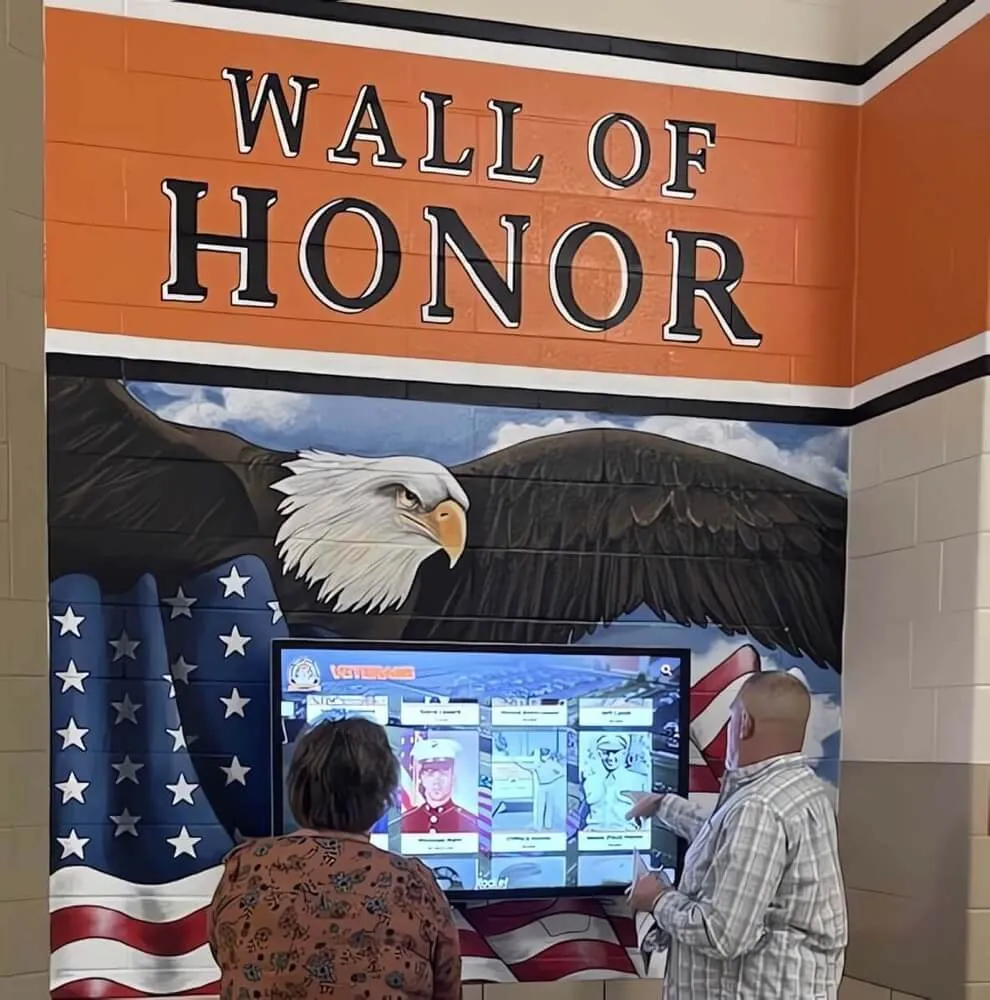

Impact Demonstration: Showing tangible outcomes from existing endowments proves powerfully persuasive. Recognition displays featuring endowed scholarship recipients, testimonials from students benefiting from endowed support, or faculty members holding endowed positions demonstrate real-world impact inspiring additional commitments.

Naming and Recognition Discussion: Exploring what permanent recognition would mean to donors and their families. Some donors value public acknowledgment celebrating achievements while others prefer discrete recognition. Understanding recognition preferences enables proposals matching donor values—suggesting named scholarships for recognition-oriented prospects or unnamed program support for privacy-preferring donors.

Professional Advisor Collaboration: Estate planning attorneys, financial advisors, and accountants often guide significant planned gift decisions. Development officers should offer collaboration opportunities educating advisors about institutional gift acceptance policies, providing charitable planning information, and facilitating technical discussions ensuring gifts structure appropriately for donor circumstances.

Patience and Long-Term Relationship Building: Endowment cultivation typically spans years not months. Unlike annual fund asks generating quick yes/no responses, endowment commitments often evolve through extended conversations, multiple meetings, relationship deepening, and gradual decision-making. Effective development officers maintain patient consistent engagement without pressure tactics potentially derailing cultivation.

Honoring Donor Intent and Managing Restrictions

Endowment stewardship requires faithful adherence to donor wishes:

Documenting Gift Agreements

Written documentation prevents future misunderstandings:

Gift Agreement Components: Comprehensive agreements include donor identification, gift amount and funding timeline, specific endowment purpose and restrictions, spending policy application, reporting commitments, recognition arrangements, and processes for handling circumstances where restrictions become impossible or impractical to fulfill.

Restriction Specificity Balance: Agreements should achieve sufficient detail ensuring clarity without excessive narrowness creating future problems. Scholarship restrictions might specify “students majoring in biology demonstrating financial need and maintaining 3.0 GPA” rather than “students from Springfield majoring in biology with red hair”—the former provides clear useful direction while the latter creates administratively difficult overly-narrow criteria potentially producing years without qualified recipients.

Modification Procedures: Agreements should address potential future circumstances requiring restriction modification—program discontinuation, criteria becoming obsolete, or intent proving impossible to fulfill. Variance procedures consistent with state law and donor communication enable appropriate adjustments when necessary while maintaining fundamental philanthropic intent.

Reporting and Stewardship Requirements

Endowment donors deserve ongoing communication about their gifts:

Annual Impact Reports: Updating donors about endowment fund performance, distribution amounts, specific uses, and beneficiary stories. Comprehensive reports might include investment returns, current fund balance, annual distribution calculation, number of students supported or programs funded, testimonials from beneficiaries, and expressions of ongoing gratitude.

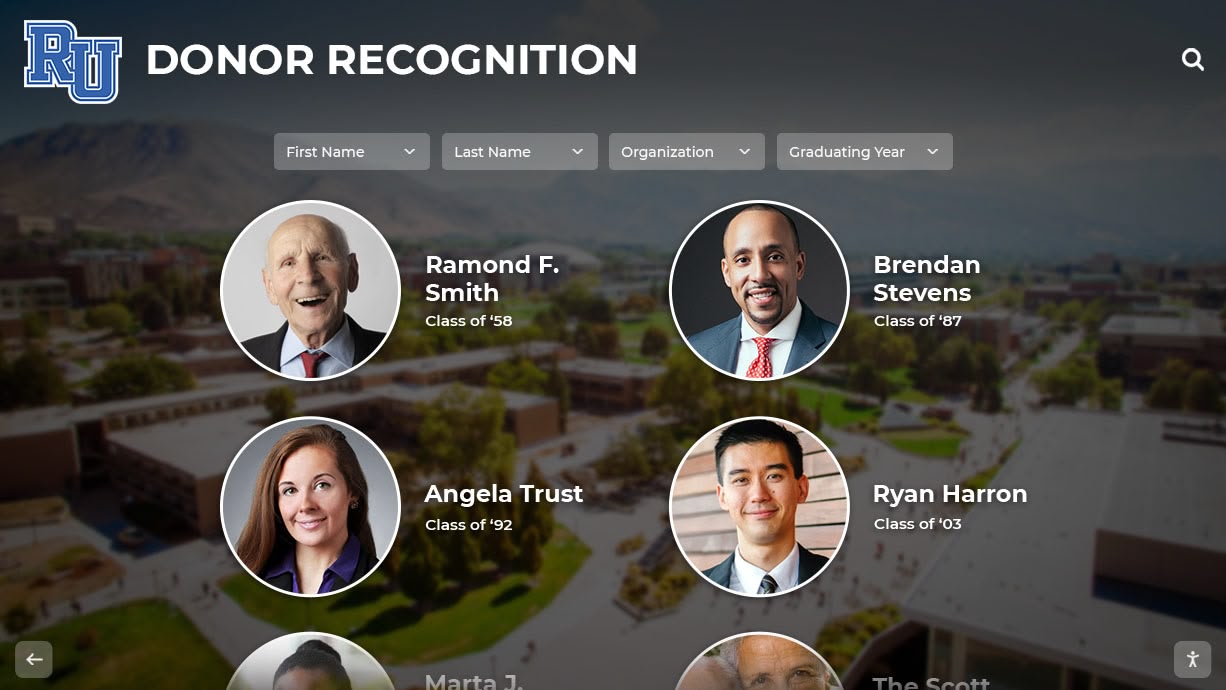

Recognition Updates: Ensuring donor acknowledgment remains current and appropriate as years pass. Digital recognition platforms enable updating donor profiles adding photos, biographical information, impact stories, and family messages—maintaining fresh engaging recognition across decades. This contrasts with static plaques becoming outdated or forgotten as facilities age and recognition areas receive less visibility.

Resources on implementing effective donor recognition systems demonstrate how strategic acknowledgment approaches support long-term donor relationships essential for endowment growth.

Phase 4: Operational Management and Administration

Effective endowment programs require sound administrative systems and financial controls:

Establishing Fund Accounting and Financial Controls

Proper accounting ensures accurate tracking and reporting:

Fund Accounting Principles

Endowments require specialized accounting approaches:

Principal vs. Income Tracking: Maintaining clear separation between original gift principal—permanently restricted against spending—and accumulated gains or losses affecting spendable amounts. Fund accounting systems track these components separately ensuring distributions come from appropriate sources and principal preservation remains clear.

Individual Fund Records: Maintaining distinct accounting for each endowment fund regardless of pooled investment management. Even when institutions invest multiple endowments together for efficiency, accounting must track each fund’s proportional share, specific restrictions, and individual distributions.

Unitization Methods: Many institutions use “unit” systems similar to mutual funds—assigning each endowment fund ownership of units in pooled investment portfolio. When institutions receive new endowment gifts, they purchase units at current market value. Distributions reduce unit holdings proportionally. This approach simplifies pooled investment accounting while maintaining precise individual fund tracking.

Spending Allocation: Calculating and distributing appropriate amounts to each endowment fund based on spending policy. Systems must track distributions ensure they align with policy calculations, apply to correct funds, and support designated purposes appropriately.

Investment Return Allocation: Proportionally assigning investment gains, losses, income, and expenses across all endowment funds based on ownership shares. Accurate allocation ensures each fund receives appropriate share of overall portfolio performance.

Financial Controls and Oversight

Strong internal controls protect endowment assets:

Segregation of Duties: Separating investment management, accounting record-keeping, and distribution authorization across different individuals preventing single-person control enabling potential misappropriation. For example, individuals authorizing endowment distributions should differ from those preparing accounting records or making investment transactions.

Regular Reconciliation: Comparing investment manager statements to internal accounting records monthly ensuring all transactions recorded accurately and balances match across systems. Discrepancies require immediate investigation and resolution.

Authorization Hierarchies: Establishing clear approval requirements for investment transactions, distributions, policy changes, and new fund acceptance. Investment committee approval typically required for manager changes, policy modifications, or unusual transactions while routine activities proceed under delegated authority with regular reporting.

External Audits: Annual independent audits provide objective assessment of accounting accuracy, control effectiveness, policy compliance, and financial statement presentation. Auditors examine endowment accounting, investment reporting, spending calculations, and donor restriction adherence—providing assurance to boards, donors, and regulators.

Transparency and Reporting: Publishing endowment information demonstrates accountability building stakeholder confidence. Annual reports typically disclose total endowment value, number of individual funds, asset allocation, investment returns, spending policy, distributions, and largest endowment purposes—creating transparency appropriate for public educational institutions even when not legally mandated.

Creating Endowment Communication and Reporting Systems

Regular reporting maintains stakeholder confidence and donor engagement:

Board and Committee Reporting

Governance bodies require comprehensive endowment information:

Quarterly Performance Reports: Updating committees and boards on investment returns, asset allocation, performance versus benchmarks, manager activities, and significant market developments affecting portfolios. Reports should present information clearly accessible to non-experts while providing sufficient detail enabling informed oversight.

Annual Comprehensive Reviews: Providing detailed endowment assessments including complete performance analysis, policy compliance review, spending distribution summary, new fund additions, total endowment growth, and strategic recommendations. Annual reviews enable boards to fulfill fiduciary oversight responsibilities demonstrating appropriate attention to endowment stewardship.

Policy Recommendation: Investment committees periodically recommend policy updates reflecting changed circumstances, market conditions, or institutional priorities. Recommendations might address spending rate adjustments, asset allocation modifications, rebalancing procedure refinements, or benchmark updates—requiring board discussion and formal approval.

Donor Communication and Stewardship

Endowment donors deserve regular meaningful updates:

Annual Fund Statements: Providing individual endowment fund performance summary, current balance, distribution amount, specific uses, and impact stories. Statements demonstrate stewardship excellence and tangible outcomes from philanthropic commitment—maintaining donor satisfaction and encouraging additional support.

Impact Storytelling: Sharing specific examples of endowment fund impact through beneficiary testimonials, program outcome data, or achievement highlights. For scholarship endowments, this might include recipient graduation news, career success stories, or personal thank-you messages creating emotional connection between donors and beneficiaries.

Recognition Platform Integration: Modern digital recognition systems enable rich ongoing storytelling impossible with static physical plaques. Platforms can feature updated photos, new impact stories, growing lists of beneficiaries served, and evolving fund information—keeping recognition fresh and engaging across decades. Solutions like Rocket Alumni Solutions provide intuitive content management enabling staff to maintain current engaging endowment donor recognition without technical expertise.

Resources on digital recognition platform implementation demonstrate how technology-enabled recognition serves endowment stewardship objectives while honoring donors appropriately.

Phase 5: Building Your Endowment Through Strategic Fundraising

Systematic endowment growth requires intentional fundraising strategies beyond opportunistic gift acceptance:

Launching Endowment-Focused Campaigns

Dedicated endowment initiatives accelerate fund building:

Endowment Campaign Planning

Focused campaigns generate momentum and results:

Goal Setting and Case Development: Establishing specific endowment targets—total dollars, number of named funds, specific purpose priorities—provides clear direction and measurable objectives. Compelling cases articulate why endowment matters—demonstrating how permanent funds create lasting institutional strength, expand student access through scholarship support, attract exceptional faculty through endowed positions, and ensure program sustainability regardless of economic conditions.

Quiet Phase Cultivation: Like capital campaigns, endowment initiatives benefit from quiet leadership phases securing major commitments before public announcements. Early leadership gifts create momentum and credibility encouraging broader participation.

Matching Gift Incentives: Challenge gifts where leadership donors match new endowment contributions dollar-for-dollar multiply impact while creating urgency motivating donor action. A $500,000 challenge gift potentially generates $1 million total endowment funding—doubling philanthropic impact while leveraging leadership generosity inspiring broader participation.

Milestone Celebrations: Recognizing achievement of campaign phases—reaching 50% of goal, securing 100 named endowments, achieving $10 million total endowment—maintains momentum and celebrates progress. Milestone events honor donors, recognize volunteers, and build excitement sustaining campaigns across multi-year timelines.

Public Phase Launch and Broad Engagement: After securing leadership commitments, public campaign phases engage broader constituencies through systematic solicitation. Alumni campaigns, parent appeals, community outreach, and corporate engagement expand endowment support beyond major donor base.

Integrating Endowment Building Into Overall Advancement

Endowment fundraising shouldn’t operate separately from broader development:

Annual Fund to Endowment Pipeline: Cultivating loyal annual fund donors toward eventual endowment commitments. Long-term consistent annual donors often prove receptive to endowment conversations—their demonstrated commitment suggests potential for larger lasting gifts. Development officers should systematically identify annual fund donors with capacity for endowment gifts, cultivate relationships, and present endowment opportunities at appropriate moments.

Capital Campaign Endowment Components: Including endowment goals within comprehensive capital campaigns addressing facility, equipment, and permanent fund needs simultaneously. Many campaigns establish goals like “$20 million total—$12 million facilities, $8 million endowment”—enabling donors to support tangible building projects or lasting endowment funds matching their philanthropic priorities.

Planned Giving Program Development: Building sophisticated planned giving programs generating endowment commitments through estate plans, charitable remainder trusts, charitable gift annuities, and retained life estates. Planned gifts often create larger endowment commitments than lifetime giving—requiring patient long-term cultivation but generating transformational results.

Volunteer Engagement: Recruiting board members, alumni leaders, and community advocates who personally commit to endowment support and actively cultivate peers. Effective volunteer networks multiply professional staff capacity while providing peer-to-peer solicitation often more effective than staff asks for major gifts.

Resources on comprehensive campaign planning strategies demonstrate how endowment initiatives integrate with broader institutional advancement frameworks.

Recognizing Endowment Donors Appropriately

Strategic recognition inspires endowment commitments while honoring generosity:

Multi-Tiered Recognition Structures

Comprehensive programs acknowledge endowment contributions across levels:

Transformational Endowment Gifts ($1M+): Major building naming rights, endowed facility designations, prominence in institutional legacy societies, featured recognition in primary campus locations, personal relationships with institutional leadership, and opportunities for family multigenerational involvement.

Leadership Endowments ($250K-$999K): Named endowed scholarships, professorships, or program funds; prominent donor wall recognition; special society membership with exclusive events and communications; personal stewardship from development leadership; and involvement opportunities in supported programs.

Significant Endowments ($50K-$249K): Named scholarship or program support; donor wall inclusion; recognition society membership; regular impact reports; and acknowledgment in institutional publications.

Supporting Endowments ($25K-$49K): Contributing to named funds or pooled endowments; donor listing; impact reports; and genuine appreciation recognizing meaningful commitment.

Tiered structures appropriately differentiate recognition by gift size while ensuring every contributor receives meaningful acknowledgment regardless of amount. Even modest endowment gifts deserve genuine appreciation—building philanthropic culture where permanent institutional support receives special honor.

Perpetual vs. Time-Limited Recognition

Endowment gifts’ permanent nature raises recognition considerations:

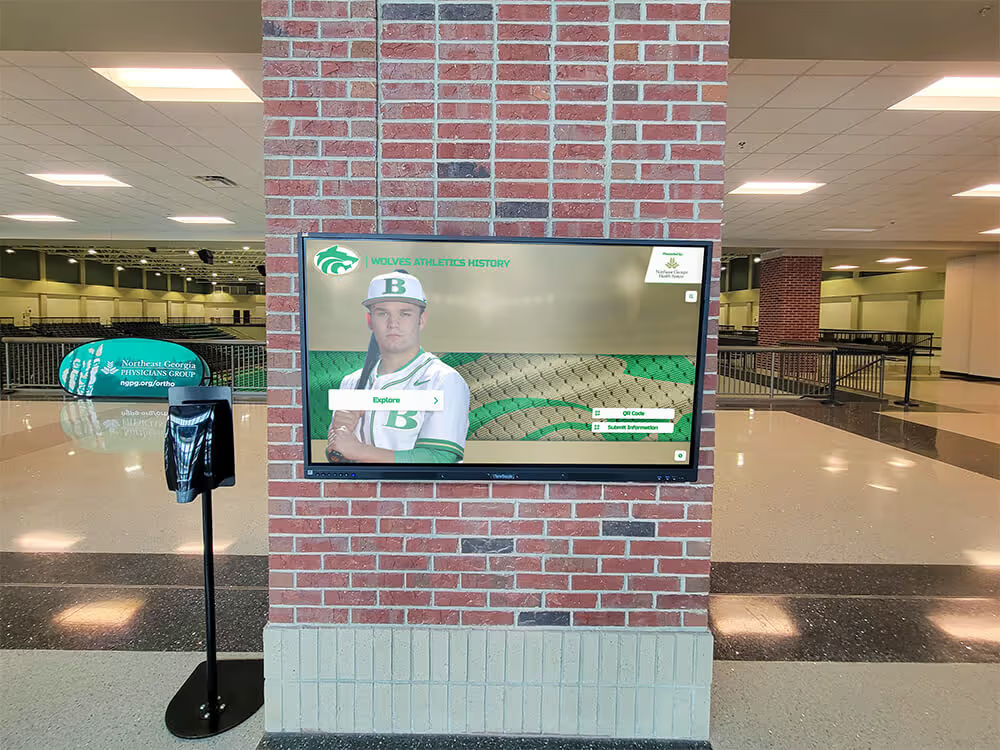

Perpetual Recognition Commitment: Because endowment gifts support institutions forever, recognition should similarly continue indefinitely. Unlike campaign gifts acknowledged during limited timeframes, endowment donors deserve lasting recognition matching their permanent commitment. This perpetuity creates challenges for physical recognition—plaques deteriorate, spaces undergo renovation, and recognition areas receive reduced visibility over decades.

Digital Recognition Advantages: Technology-enabled recognition platforms solve perpetuity challenges inherent in physical displays. Digital systems accommodate unlimited donors without physical space constraints, enable regular content updates maintaining fresh engaging recognition, provide searchable databases helping visitors discover relevant information, offer remote web access extending recognition beyond physical campus locations, and facilitate ongoing additions as new endowment gifts arrive—all essential capabilities for recognition systems serving endowments spanning decades or centuries.

Recognition Policy Consistency: Establishing written recognition policies prevents future problems. Policies should specify recognition levels tied to gift amounts, processes for handling recognition when donors pass, procedures for family requests modifying recognition details, and approaches to maintaining accurate information as circumstances evolve. Clear documented policies enable consistent equitable recognition decisions across leadership transitions and changing institutional circumstances.

Common Endowment Management Challenges and Solutions

Experienced administrators anticipate predictable obstacles enabling proactive problem-solving:

Challenge: Building Endowments During Strong Markets

Rising markets create pressure to raid endowments for current needs rather than maintaining spending discipline.

Solutions: Maintaining written spending policies and board commitment to long-term stewardship prevents short-sighted decisions. Communicating clearly to stakeholders that strong returns reflect market gains not operational surplus requiring preservation through disciplined spending. Emphasizing intergenerational equity ensuring current beneficiaries don’t consume resources belonging to future generations. Demonstrating how spending discipline during good markets enables sustained distributions during inevitable downturns.

Challenge: Managing Donor Expectations About Immediate Impact

Donors sometimes struggle understanding why endowment gifts don’t immediately fund programs in full amount given.

Solutions: Patient education explaining investment, spending rates, and long-term value. Using clear examples—“Your $100,000 scholarship endowment generates approximately $4,000-$5,000 annually in perpetuity, supporting a student every year forever”—makes abstract concepts concrete. Providing first-year distribution information alongside total gift amount helps donors understand near-term impact. Emphasizing multigenerational legacy appeal for donors valuing permanent institutional support.

Challenge: Administering Numerous Small Restricted Endowments

Institutions sometimes accumulate dozens or hundreds of small endowments with varying restrictions creating administrative burden.

Solutions: Establishing realistic minimum gift thresholds for new named endowments—typically $25,000-$50,000—prevents proliferation of administratively burdensome small funds. Offering pooled endowment options for gifts below naming thresholds enabling modest contributions supporting general institutional priorities without individual fund administration. Periodically reviewing very old small endowments with outdated restrictions, pursuing donor family contact for modification discussions when restrictions prove impossible or impractical to fulfill.

Challenge: Balancing Current Needs Against Endowment Building

Schools facing pressing immediate needs sometimes struggle prioritizing long-term endowment development over urgent operating support.

Solutions: Developing balanced advancement strategies including annual fund for operations and endowment initiatives for sustainability—explaining each purpose clearly to donors matching gifts with appropriate needs. Articulating compelling endowment cases demonstrating how permanent funds create lasting solutions to recurring problems. Starting modestly with focused endowment campaigns for specific high-priority needs like scholarship access or key faculty positions rather than general endowment. Building endowment cultivation into major gift conversations presenting both current and endowment options letting donors choose based on philanthropic priorities.

Technology and Modern Endowment Management

Contemporary tools enhance endowment administration and donor engagement:

Endowment Management Software

Specialized platforms streamline complex endowment oversight:

Modern endowment management systems typically integrate with general fund accounting tracking individual endowment balances, calculating spending distributions automatically based on policy parameters, allocating investment returns proportionally across funds, maintaining compliance with spending and legal requirements, and generating reports for boards, donors, and regulatory filings. Cloud-based solutions increasingly replace legacy on-premises systems—providing enhanced accessibility, automatic updates, improved security, and mobile capabilities enabling remote access.

Digital Recognition and Engagement Platforms

Technology-enabled recognition extends beyond traditional approaches:

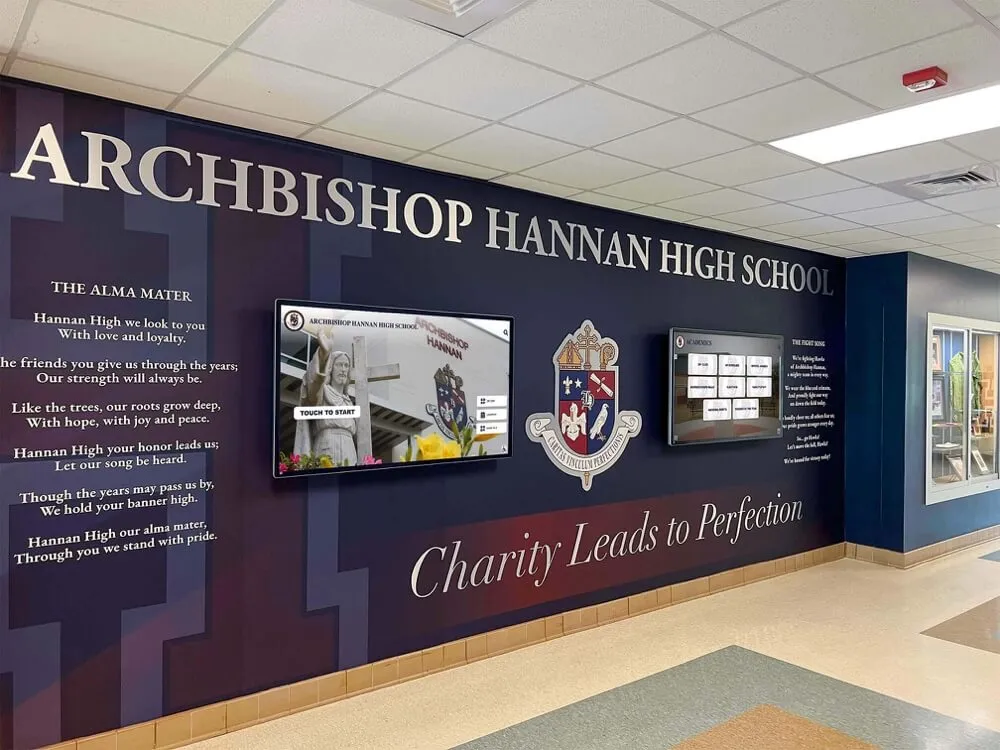

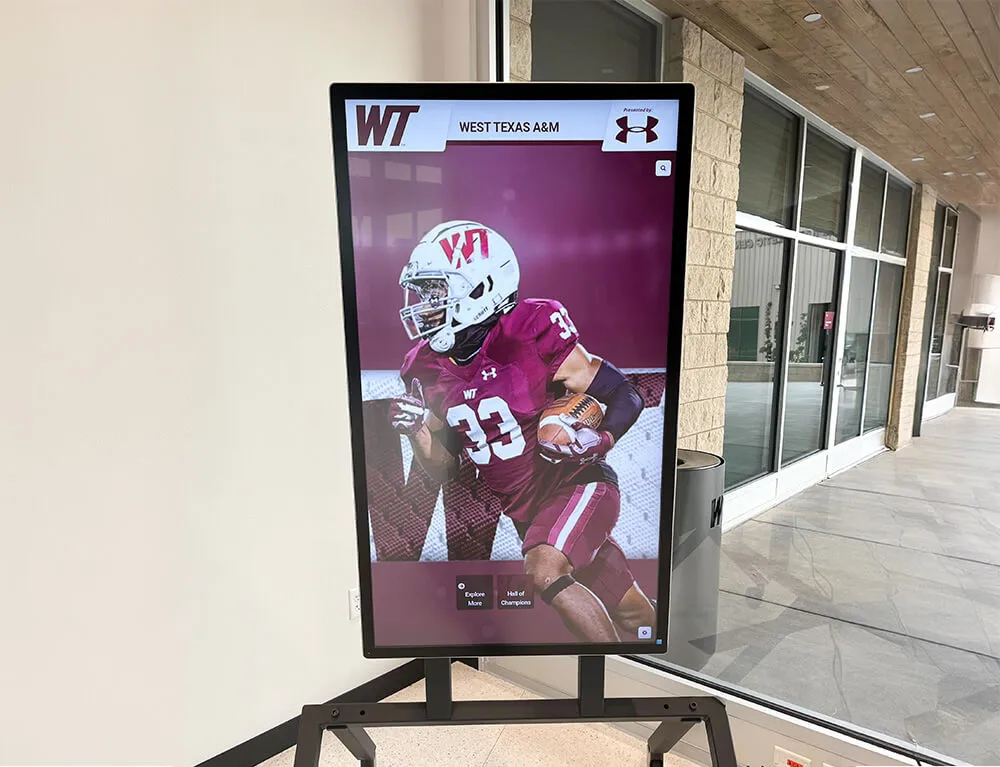

Modern digital recognition platforms provide capabilities impossible with physical plaques alone. Schools implement interactive touchscreen displays in prominent facility locations enabling visitors to explore endowment donor profiles through intuitive search and filtering. Web-based recognition portals allow endowment donors anywhere to view acknowledgment and share recognition with personal networks. Mobile applications provide endowment impact updates and donor recognition access on smartphones.

These technology-enabled approaches supplement traditional recognition with richer more engaging donor appreciation. Digital platforms accommodate unlimited endowment donors without physical space constraints, enable instant content updates as new gifts arrive, tell multimedia stories featuring photos and videos demonstrating endowment impact, provide searchable databases helping visitors discover relevant information, and capture engagement analytics revealing which recognition content resonates most effectively—informing stewardship strategies.

Solutions like Rocket Alumni Solutions deliver purpose-built recognition platforms designed specifically for educational endowment donor recognition, combining intuitive content management non-technical staff update easily, professional presentation templates ensuring consistent quality, flexible categorization supporting multiple endowment types simultaneously, and reliable technical infrastructure requiring no IT expertise or ongoing maintenance burden.

Building Your Endowment Foundation

Establishing endowment funds represents one of the most significant strategic initiatives schools undertake—creating permanent financial foundations supporting educational missions across generations. Success demands careful attention to legal structure and governance, professional investment management balancing growth with preservation, comprehensive gift acceptance policies enabling complex contributions, faithful stewardship honoring donor intent, systematic fundraising building endowment over time, and strategic recognition inspiring commitments while honoring generosity appropriately.

Schools achieving endowment success share common characteristics: board commitment to long-term financial sustainability, written policies guiding investment and spending decisions, professional investment management delivering competitive returns, clear gift acceptance frameworks enabling diverse contribution types, systematic donor cultivation building endowment through dedicated campaigns, and comprehensive recognition systems honoring endowment donors appropriately across decades.

The infrastructure schools build for endowment management—governance frameworks, investment policies, fund accounting systems, donor recognition platforms—serves institutional missions far beyond initial fund establishment. When schools invest systematically in endowment development and stewardship, they don’t merely create permanent funding for specific programs—they build comprehensive financial sustainability strengthening institutions permanently.

Ready to establish endowment funds with recognition systems that inspire generous commitments while honoring donor contributions appropriately across generations? Modern donor recognition platforms purpose-built for educational endowment programs enable schools to acknowledge unlimited contributors without physical space constraints, update recognition instantly as new gifts arrive maintaining fresh engagement, tell rich multimedia stories demonstrating endowment impact and donor generosity, provide web-based access extending recognition visibility globally, capture engagement analytics revealing recognition effectiveness, and manage content through intuitive interfaces requiring no technical expertise.

Your school community includes alumni, parents, community members, and foundations who value educational excellence and want to contribute to lasting institutional strength. Strategic endowment programs with comprehensive donor recognition systems mobilize this philanthropic capacity—building permanent financial foundations that serve students for generations while establishing lasting relationships that sustain your institution’s mission far into the future.

Explore how Rocket Alumni Solutions delivers comprehensive recognition platforms designed specifically for educational endowment programs. Transform donor appreciation from basic acknowledgment into strategic advancement infrastructure that inspires generous commitments, celebrates lasting generosity, and builds institutional culture of philanthropy supporting your school’s mission for decades to come.